Below are the details of the law.Įconomic Growth, Regulatory Relief and Consumer Protection Act, Īlthough it is not yet time for the law to enforce these free credit freezes, it appears that all five credit bureaus are now offering free online credit freezes. Starting September 21, 2018, no matter where you live you’ll be able to get a free credit freeze for kids under 16 years old. Currently, some state laws allow you to freeze a child’s credit file, while others do not. Further, the law also provides additional ID theft protections to minors. Now, Equifax, Experian and TransUnion must each set up a webpage for requesting fraud alerts and credit freezes at no cost, due to new U.S. Previously, the cost was $10 per credit bureau for every freeze/unfreeze. A fraud alert requires creditors who check your credit report to take steps to verify your identity before opening a new account, issuing an additional credit card, or increasing the credit limit on an existing account based on a consumer's request. An initial fraud alert lasts up to 1 year unless you decided to remove it sooner.One of the most vital steps you can take toward protecting yourself from identity theft is to obtain a credit freeze.

Tip: If you think you may have been the victim of identity theft, you can also file a fraud alert. Additionally, if the nationwide credit reporting company does not have a file on the protected consumer at the time the security freeze is requested by the parents or guardians, the company will create a record in order to freeze the record for the “protected consumer.” This record of the “protected consumer” may not be used for credit purposes and may only be used to freeze the record to protect against identity theft.Persons with authority to act for these protected consumers can request a security freeze. Federal law provides protections related to credit records and identity theft for “protected consumers” under the age of 16 and incapacitated persons or persons for whom a guardian has been appointed.Security Freeze for “Protected Consumers”

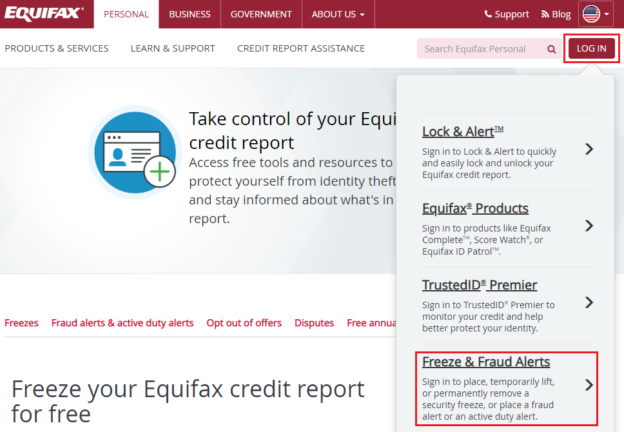

The same time periods above apply to a temporary removal of your security freeze. You also have the option to lift the freeze temporarily for a period of time specified by you, free of charge.3 business days after receiving the request by mail.1 hour after receiving the request by toll-free telephone or secure electronic means.The security freeze will be removed no later than: Upon your request, the security freeze can be removed free of charge.The nationwide consumer reporting company’s webpage must also allow you to request a security freeze, an initial fraud alert, an extended fraud alert, and an active duty fraud alert.

#CREDIT FREEZE EQUIFAX HOW TO#

They must also tell you of how to remove the security freeze.

#CREDIT FREEZE EQUIFAX FOR FREE#

Under a federal law effective September 21, 2018, you can freeze and unfreeze your credit record for free at the three nationwide credit reporting companies – Experian, TransUnion, and Equifax.

0 kommentar(er)

0 kommentar(er)